In the final full week before the presidential election on Tuesday, November 5, it may be hard for any single data report to break through the noise. However, there are two reports that should rise above the clamor. Any surprises to the up- or down-side will get politicized in on social media, but this should be short-lived in the final days as the candidates make their respective cases to voters.

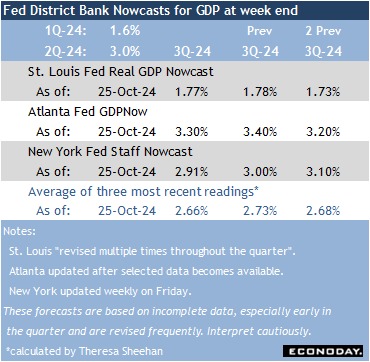

The advance estimate for third quarter GDP is at 8:30 ET on Wednesday. Growth of around 2.5 to 3.0 percent seems likely, which is little different from the up 3.0 percent in the second quarter. The three GDP Nowcasts from the New York, St. Louis, and Atlanta Feds forecast growth at 2.91 percent, 1.77 percent, and 3.30 percent, respectively. Historically, the Atlanta Fed forecast has the strongest correlation with the actual result. In any case, solid consumer spending should keep modest growth on track.

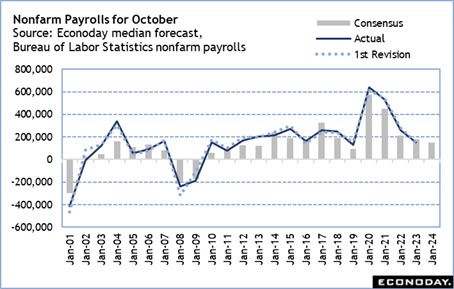

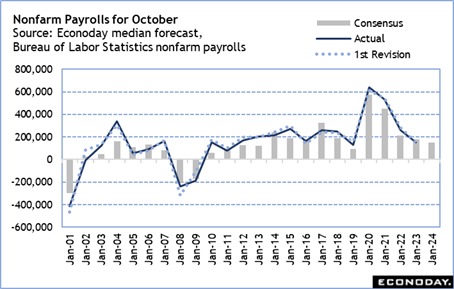

The monthly employment report is at 8:30 ET on Friday. Early forecasts look for about a 150,000 rise in payrolls for October. There are two special factors that might lead to a surprise.

The first is Hurricane Helene’s impact on large parts of the Southeast. Widespread devastation can make it difficult for the statistical agency to collect the normal data. Establishments may be hard to contact and unusual circumstances make it difficult to answer the standard questions. The same can be true of the household survey side. The BLS has experience dealing with this sort of challenge, but it may have an impact nonetheless. It may also result in more revisions than usual when the November data is released on December 6 at 8:30 ET.

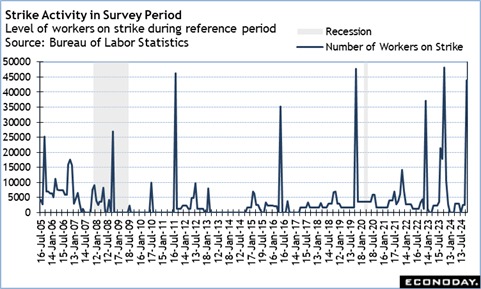

The second is strike activity. There is two new strikes in aerospace that affects 38,000 workers. These workers will be deducted from October manufacturing payroll counts. Additionally, there is a new strike of 3,400 hotel workers which will be deducted from leisure and hospitality payrolls. These one-time impacts. They will be added back in once each strike is settled, whenever that is. However, the strikes at Boeing and Textron may result in some layoffs and/or delays in hiring at businesses that are part of the chain of goods and services for aircraft manufacture. Businesses are reluctant to lose workers now who may be harder and/or most costly to replace later. But if the strike drags on, there could be effects in the coming weeks or months.

Past performance is not indicative of future results

—

Originally Posted October 25, 2024 – High points for economic data scheduled for October 28 week

Disclosure: Econoday Inc.

Important Legal Notice: Econoday has attempted to verify the information contained in this calendar. However, any aspect of such info may change without notice. Econoday does not provide investment advice, and does not represent that any of the information or related analysis is accurate or complete at any time.

© 1998-2022 Econoday, Inc. All Rights Reserved

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Econoday Inc. and is being posted with its permission. The views expressed in this material are solely those of the author and/or Econoday Inc. and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at the Warnings and Disclosures section of your local Interactive Brokers website.

Join The Conversation

If you have a general question, it may already be covered in our FAQs page. go to: IBKR Ireland FAQs or IBKR U.K. FAQs. If you have an account-specific question or concern, please reach out to Client Services: IBKR Ireland or IBKR U.K..

Visit IBKR U.K. Open an IBKR U.K. Account