Originally Posted 23 Oct 2024 – Silver could Shine amid a Turbulent Economy and Solar Capacity Growth

Authored by: Roberta Caselli

Past performance is not a guide to future returns.

Silver appears to be setting up for its strongest run in decades. With the Federal Reserve (“Fed”) potentially poised for rate cuts, and 2024 possibly shaping up to be a year of fundamental deficits, the silver market looks set for a breakout.1 2Silver has surged to its highest level in over a decade, and gold is hitting record highs, largely driven by the momentum of expected interest rate reductions.3 4 However, some see broader forces such as, monetary policy shifts, geopolitical risks, and the US election shaping a turbulent economy where silver could shine as a store of value.5 On the fundamentals, booming demand from China’s solar and EV industries fuelled by the energy transition is adding to silver’s outlook according to the International Energy Agency.6

Key Takeaways

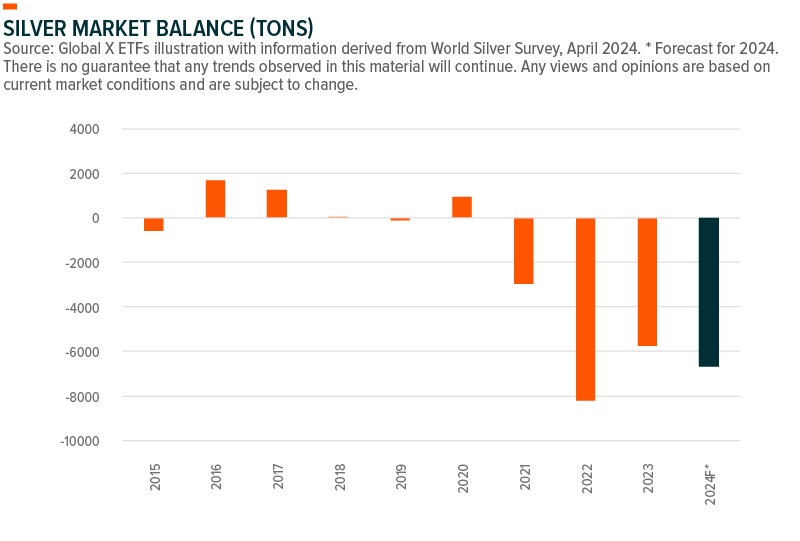

- Due to rising industrial demand and the lack of visible supply expansion, a fourth year of deficit may be on the horizon.

- China’s silver imports are expected to increase further as its renewable energy push accelerates.

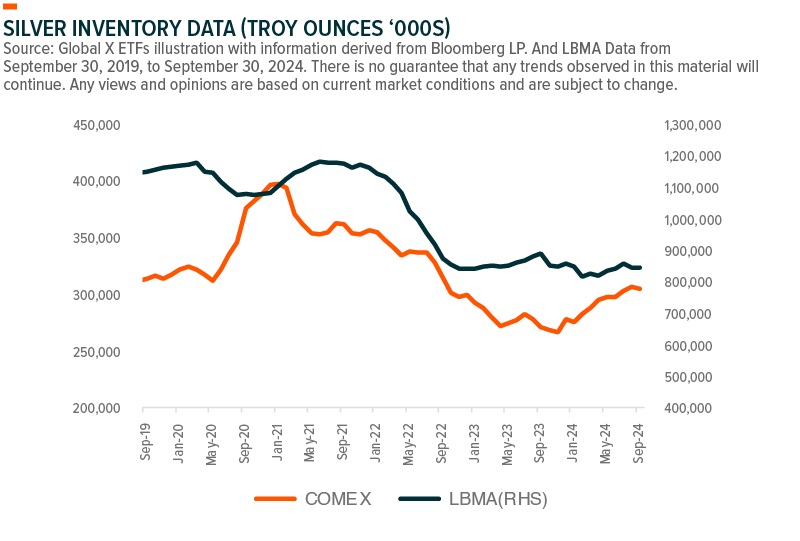

- Though above-ground silver inventories may limit industrial-fuelled price upside in the short term, currently, macro drivers such as the Fed easing cycle could support silver more than gold.

A Fourth Year of Deficit is on the Horizon

Silver physical demand surpassed supply in 2023, following a three-year pattern; the global market deficit was down by 30% year over year (yoy) from 2022’s likely all-time high, but it was still one of the greatest at 184.3Moz.7

2023 saw silver’s industrial demand continue to rise, achieving a record due to high solar demand.8 Sluggish supply played a role in the previous registered deficit as well.9 Due to the possibility of medium-term industrial demand growth and the lack of visible supply expansion, deficit circumstances may remain, with a fourth year of deficit seemingly on the horizon. The Silver Institute has already predicted a 17% supply-demand gap for this year, driven by rising industrial demand, a rebound in jewellery and silverware, and sluggish mine production and recycling.10

Furthermore, the solar panel industry could significantly increase industrial silver use to a record high this year.11

Past performance is not indicative of future results

China’s Energy Transition Goals to be a potential Boon for Silver’s Industrial Demand?

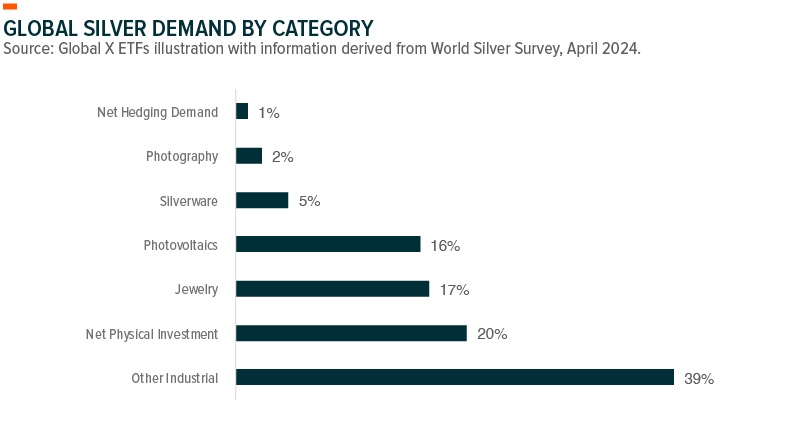

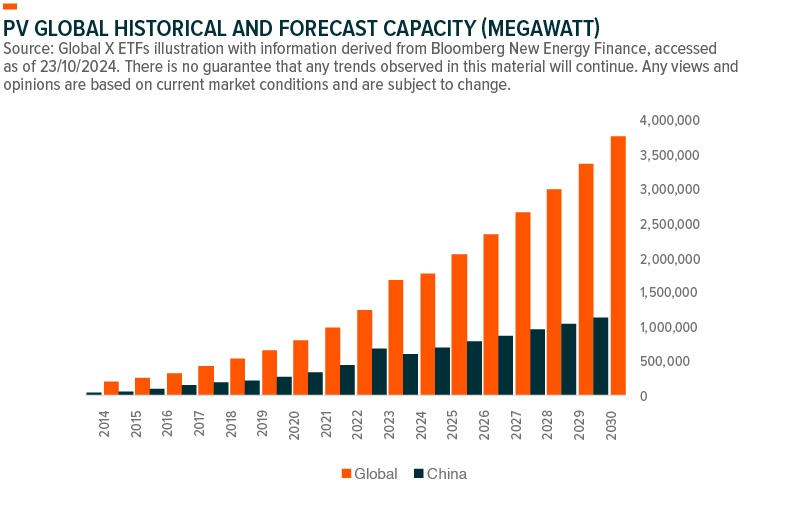

In 2023, silver industrial output reached another record at 654.4Moz, up 11% yoy; amid higher-than-expected Solar photovoltaic (PV) capacity increases.12 This year, global industrial usage is projected by the Silver Institute to grow by another 9%, driven again by green applications like solar panels.13

In recent months, China’s silver demand has risen by over 20% yoy, powered by strong fundamental demand across solar, EVs and electronics.14 China’s silver industrial usage jumped 44% in 2023 alone and now accounts for 40% of global silver industrial demand.15 With over 80% of world’s solar panels produced in China, the outlook for silver potentially remains bright.16

Further, and according to BloombergNEF’s base case, globally, the capacity of installed solar PV is expected to increase 125% by 2030 from a 2023 base, with China accounting for most of this projected growth and domestically expected to potentially increase the installations by 66% over the same period.17 In northwestern Xinjiang, a Chinese state-owned business connected the world’s largest solar facility to the grid, is set to generate 6.09 billion kilowatt hours of electricity annually.18 This milestone signals even greater demand for solar panels, potentially driving China’s silver imports higher as its renewable energy push accelerates.

Beyond China, despite high global silver prices which have traditionally discouraged Indian silver imports, India’s silver imports surpassed the total combined for 2023 already in the first four months of this year.19

Past performance is not indicative of future results

Past performance is not indicative of future results

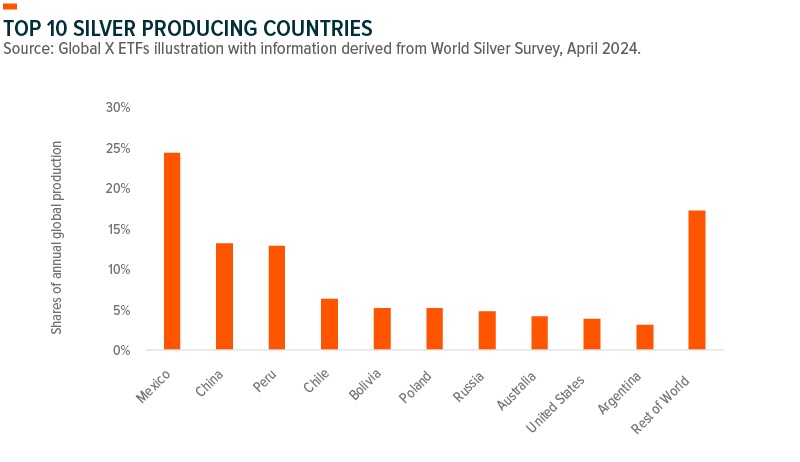

The global silver market is also deficit-ridden owing to sluggish supply of which major producers in Mexico appear to be primarily responsible: global mining production declined 1% year over year to 830.5Moz in 2023 as Mexico experienced its first 5% yoy reduction in output since 2020 due to strike actions.20

Looking forward, silver output from copper and zinc miners may continue to be hampered by socio-political stoppages and falling ore quality in 2024; still, it could rise in 2025 as miners recover from underinvestment and maintenance delays.21

So far, high above-ground inventories have prevented a physical squeeze in the market.22 However, inventories are finite and might eventually further decrease, allowing the market to tighten further.

Past performance is not indicative of future results

Past performance is not indicative of future results

FED’s Easing Cycle to be Supportive of Precious Metals

Though above-ground silver inventories may limit industrial-fuelled price upside in the short term, currently, macro drivers could support silver more than gold.

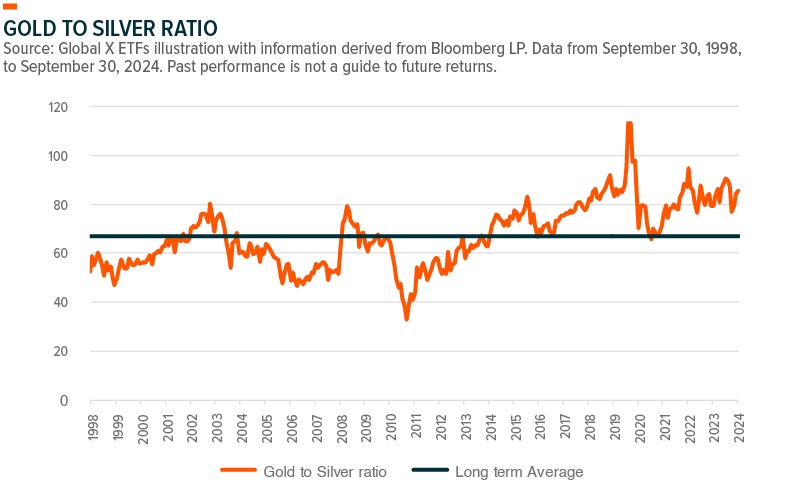

Given their status as precious metals, silver and gold are easily comparable. Two critical differences between the pair are firstly their respective market sizes, with silver being much smaller than gold, and secondly the industrial usage, which contributes to around 54% of silver’s annual demand while only around 7% of gold’s.23 24 Despite these distinctions, silver is often called “second gold” as lower real yields, and a weaker US dollar might boost both precious metals.25

The gold-to-silver ratio, a metric which shows how much silver is needed to buy an ounce of gold, has averaged 67 in the last 30 years.26 With gold sitting at record highs and the ratio now above 80, silver may offer opportunities if it is cheaper than gold.27

Past performance is not indicative of future results

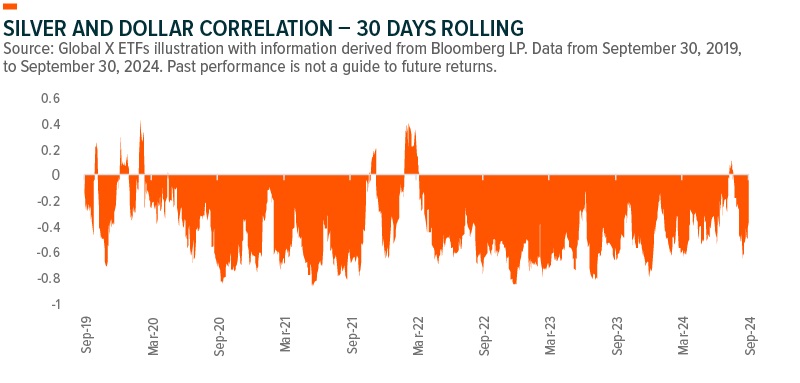

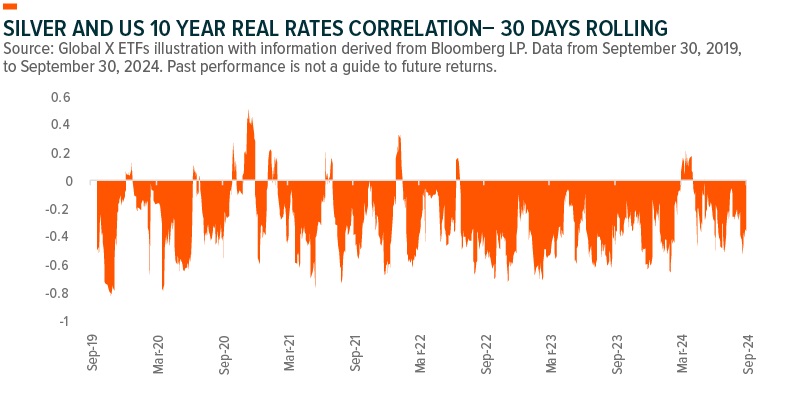

As an additional tailwind, the current macro-environment impacts silver as it is inversely related to the dollar and may serve as an inflation hedge and portfolio diversifier/safe haven for some investors.28 Among multiple central banks easing cycles, and especially among the Fed’s one, falling real rates could cut the opportunity cost of silver, potentially boosting its investment profitability.29 30

Dovish monetary policy, US election uncertainties, geopolitical threats, and market volatility may benefit ‘safe-haven’ assets like silver and gold. Fed Chair Jerome Powell’s Jackson Hole address, in which he pledged rate cuts, was a turning point leading to a renewed dovish tone.31 In September, the US central bank cut rates more than expected for the first time in four years, lowering its benchmark lending rate objective by 0.5 percentage points to 4.75%-5%.32

Past performance is not indicative of future results

Past performance is not indicative of future results

Past performance is not indicative of future results

Conclusion

The dual nature of silver as both a precious and industrial metal makes it entirely unique. Since silver can appreciate during both periods of high economic growth (when industrial demand is expanding) and times of high volatility (when demand for precious metals is rising), we think that a direct or indirect exposure to it could be strategic holding in an investor’s portfolio. Particularly now, when dovish monetary policies, geopolitical threats, and US elections are creating a fractured economy, silver could shine as a potential store of value. At the same time, China’s strong solar silver demand could further exacerbate the fundamental deficit.

This document is not intended to be, or does not constitute, investment research

Footnotes

- Morningstar (18/09/2024) Fed Cuts Rates by Half-Point in Aggressive Start to Easing Cycle

- The Silver Institute (17/04/2024). World Silver Survey 2024.

- Bloomberg Data as of 16/10/2024. Gold and Silver Spot Last Price. Silver spot price highest level at 34.85$/Ozon 22/10/2024 since 10/05/2012. Gold spot price highest level at 2,749.01 $/Oz on 22/10/2024 since data are recorded in 1920.

- The Guardian (15/09/2024) The Federal Reserve is about to cut rates … but by how much?

- Forbes (18/09/2024) How Presidential Elections Affect The Stock Market

- International Energy Agency Solar PV Global Supply Chains Executive Summary. Accessed as of 22/10/2024.

- The Silver Institute (17/04/2024). World Silver Survey 2024.

- Ibid

- Ibid

- Ibid

- Demand Outlook. (April 2024) World Silver Survey 2024.

- Ibid

- Ibid

- Barrons (26/09/2024) Silver Outshines Gold. Why the Rally Isn’t Over.

- World Silver Institute (17/04/2024). Data- World-Silver-Survey-2024- Industrial demand by country

- International Energy Agency Solar PV Global Supply Chains Executive Summary. Accessed as of 22/10/2024.

- BloombergNEF forecasts data as of 22/10/2024.

- Reuters (7/06/2024) World’s biggest solar farm comes online in China’s Xinjiang

- Reuters (29/05/2024) India imports more silver in 4 months than in all of 2023

- The Silver Institute (17/04/2024). Silver Supply in 2023.World Silver Survey 2024

- The Silver Institute (17/04/2024). World Silver Survey 2024

- LBMA & Comex Silver Inventories. Data as of 22/10/2024

- Silver Supply & Demand. World Silver Survey 2024

- Gold Supply & Demand. World Silver Council 2024

- Bloomberg correlation data of gold and silver against real rates and USD dollar as of 22/10/2024

- Bloomberg Data as of 22/10/2024. Gold to silver ratio.

- Ibid

- Bloomberg correlation data of silver and USD dollar as of 22/10/2024

- IMF Blog (22/10/2024) As Inflation Recedes, Global Economy Needs Policy Triple Pivot

- The Economic Times (18/10/2024) Silver ETFs offer good investment opportunity amidst market volatility.

- The Guardian (23/08/2024) Federal Reserve’s Jerome Powell says ‘the time has come’ for US interest rate cuts – as it happened

- Reuters (19/09/2024) Fed unveils oversized rate cut as it gains ‘greater confidence’ about inflation

- MarketWatch (21/10/2024) Worries about deficit spending after election bog down U.S. government debt

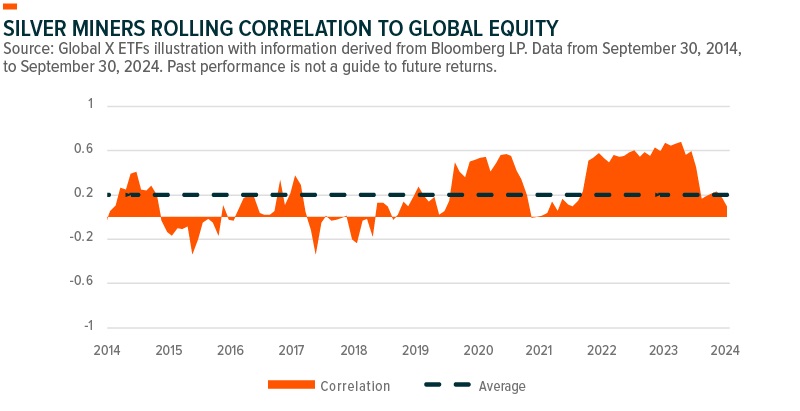

- Bloomberg data as of 22/10/2024. Silver miners rolling correlation to global equity

Disclosure: Global X ETFs

Carefully consider the Fund’s investment objectives, risk factors, charges and expenses before investing. This and additional information can be found in the Fund’s full or summary prospectus, which may be obtained by calling 1-888-GX-FUND-1 (1.888.493.8631), or by visiting globalxfunds.com. Read the prospectus carefully before investing.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Global X ETFs and is being posted with its permission. The views expressed in this material are solely those of the author and/or Global X ETFs and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs page. go to: IBKR Ireland FAQs or IBKR U.K. FAQs. If you have an account-specific question or concern, please reach out to Client Services: IBKR Ireland or IBKR U.K..

Visit IBKR U.K. Open an IBKR U.K. Account